Understanding the basics of crypto, blockchain, and how to start investing wisely in digital assets.

Cryptocurrency 101 has evolved from a niche internet experiment to a global financial phenomenon. If you’re new to the world of crypto, it can feel complex and even a bit intimidating. This beginner’s guide keeps the full picture intact and adds practical tips so you can understand how cryptocurrencies work and what to consider before investing.

What Are Cryptocurrencies?

At its core, a cryptocurrency is digital money designed to be secure and, in many cases, decentralized. Unlike traditional currency issued by governments (like dollars or euros), cryptocurrencies such as Bitcoin operate on a technology called blockchain—a distributed ledger enforced by a network of computers (nodes) rather than a central authority.

This means transactions are verified and recorded across many computers around the world. The first and best known cryptocurrency, Bitcoin, launched in 2009. Since then, tens of thousands of other cryptocurrencies have emerged, typically aiming at specific purposes or utilities—payments, smart contracts, privacy, or application tokens.

Blockchain Basics

Think of a blockchain as a public ledger that records every transaction. When you send or receive cryptocurrency, your transaction is bundled with others into a block. That block is then added to the chain of previous blocks (hence the name blockchain) and secured using cryptography.

The innovation is immutability: once a block is added and confirmed by the network, altering past records is extremely difficult. This makes fraud hard and allows strangers to trust the system without relying on a bank or other middleman—integrity comes from code and consensus.

Key Concepts: Decentralization & Security

Decentralization. Most cryptocurrencies are decentralized: no single company, bank, or government controls the network. Anyone who meets the technical requirements can participate in validating transactions according to the protocol rules.

Security. Cryptocurrencies rely on cryptographic algorithms and consensus mechanisms. Bitcoin uses Proof of Work (PoW): specialized computers (“miners”) compete to solve puzzles that validate transactions and add new blocks, earning coins as rewards. Newer networks often use Proof of Stake (PoS), where participants stake coins to secure the network—generally more energy-efficient and faster. For large, established networks, altering the ledger would require enormous computing power or controlling a majority of the network—impractical in practice.

Popular Cryptocurrencies

While Bitcoin is often called “digital gold,” several other projects are central to the ecosystem:

- Ethereum (ETH): Introduced smart contracts—programmable agreements that power decentralized apps, DeFi, and NFTs.

- Stablecoins (USDT, USDC): Pegged to stable assets (usually the US dollar) to reduce volatility for payments and trading.

- Ripple (XRP): Aims at fast, low-cost cross-border transfers often discussed in banking contexts.

- Litecoin (LTC): A faster, lighter variant of Bitcoin with lower typical transaction fees.

The long tail contains thousands of experimental coins; many lack sustainable utility. Approach lesser-known tokens with skepticism and research.

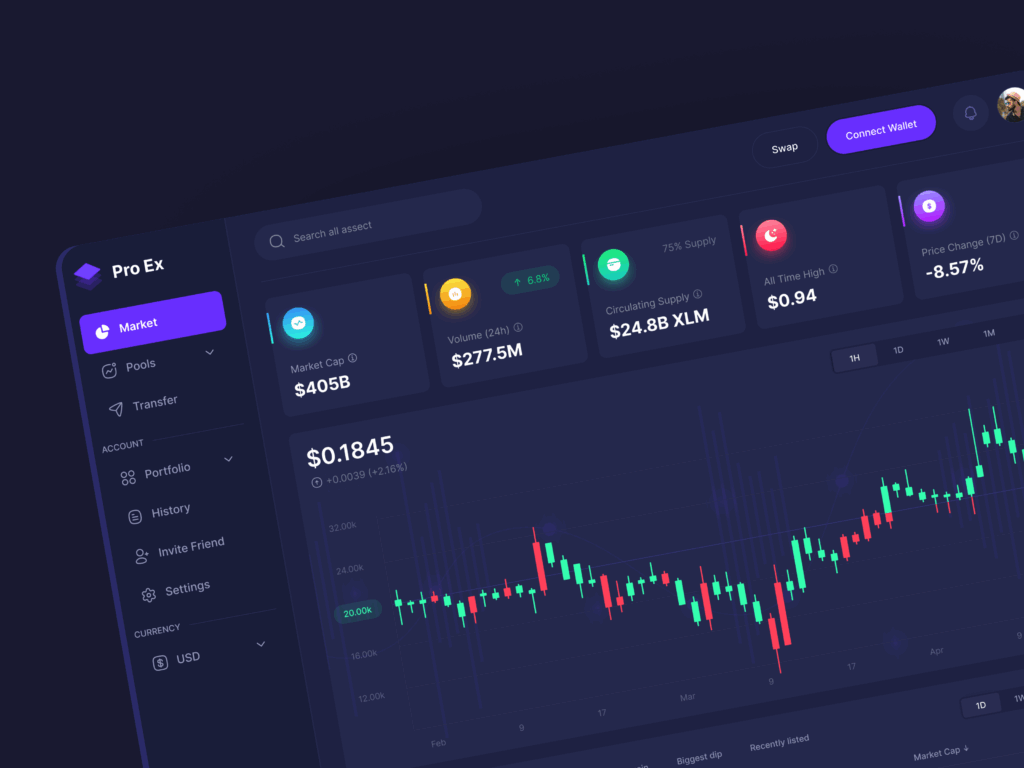

Investing in Crypto – Tips & Risks

Volatility

Cryptocurrencies are highly volatile. Prices can rise or fall dramatically in hours. Volatility creates opportunity—and risk. A simple rule protects beginners: never invest money you can’t afford to lose.

Security

Owning crypto means managing a wallet and private keys. Your private key proves ownership of funds; if it’s lost or stolen, recovery is usually impossible. Many beginners buy on reputable exchanges and later move funds to a personal wallet (hardware or software) for more control.

Do Your Research

With thousands of assets, due diligence is non-negotiable. Read whitepapers, check the team’s track record, look for open-source code, and understand the token’s use case. Start with established assets like BTC and ETH before exploring riskier plays.

Regulation & Scams

Rules around crypto vary by country and continue to evolve (taxation, exchange licensing, securities classification). Scams—phishing, fake airdrops, Ponzi schemes—are common. Always verify URLs, enable two-factor authentication, and be wary of guaranteed-profit claims.

Diversification

Treat crypto like a speculative asset class within a broader portfolio. Diversifying across assets and limiting overall exposure can reduce downside risk if a single project fails.

The Potential and Future

Supporters argue that cryptocurrencies and blockchains could be as transformative as the early internet. Potential applications include bankless global payments, transparent supply chains, tamper-resistant records, and programmable finance that operates 24/7 without traditional intermediaries.

Major companies experiment with crypto payments and tokenization; banks explore blockchain-based settlement; governments pilot central bank digital currencies (CBDCs). Challenges remain—scalability, energy use (especially under PoW), and user experience—but the space evolves quickly. For beginners, a sensible path is to start small, learn wallet security, follow reputable sources, and build discipline over hype.

“Don’t invest in what you don’t understand.” In crypto, curiosity plus caution beats FOMO every time.

Further Reading

For clear definitions, market context, and investor checklists, see the Investopedia Cryptocurrency Guide. It complements this overview with examples, glossary terms, and risk frameworks for new and intermediate investors.